The Internal Rate of Return, also known as IRR according to Abbreviationfinder.org, is a rate used as a reference for when an investment can have a return equal to zero.

The IRR is used as a discount rate, as we update the values for the initial investment moment, different from the interest rates in which the final value is capitalized, that is, accumulated.

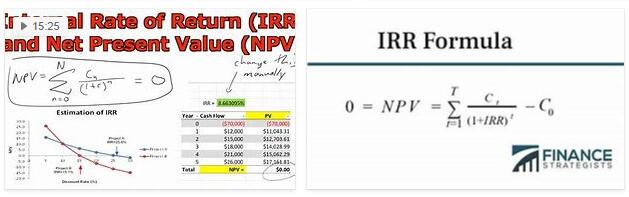

When updating the value of an investment we obtain the so-called Net Present Value (NPV), which in the case of calculating the IRR we want to find out what the discount rate for a NPV is equal to zero.

IRR concept and how to interpret its value

The IRR can be used in comparison to an expected interest rate on an investment, also known as the Minimum Attractiveness Rate, and which should demonstrate the viability of a project.

We can interpret it as that the higher the Minimum Attractiveness Rate to make an investment, the lower its return or profitability.

The interpretation can be followed from this table:

| IRR greater than Minimum Attractiveness Rate | Net Present Value is positive | Investment is feasible |

| IRR lower than the Minimum Attractiveness Rate | Net Present Value is negative | Investment is not viable |

How to calculate IRR

The IRR is calculated for a NPV that is equal to zero, where the investment is neither profit nor loss.

The calculation is made by adding each cash flow entry minus the initial investment, where this value is equal to zero, using the formula:

FC = cash flows

i = period of each investment

N = final period of the investment

With this formula we obtain what the updated value would be for each receipt, between all periods, and after an initial investment that takes a negative value, since it was an outflow of money.

Example

As a simple example, calculating the IRR for an invested amount of R $ 200.00 with a return after 1 year in the amount of R $ 250.00, has a rate of:

This is the simplest example for calculating the IRR. To calculate with more cash flows and in many periods, the IRR becomes an unknown factor that can only be discovered using adequate resources, such as the financial calculator or Microsoft Excel.

How to calculate IRR in Microsoft Excel

The calculation of the IRR in Excel is done by adding all the cash flows of an investment, with the initial amount invested being negative and the entire return on having invested in this project.

The IRR is obtained when we type in a blank line “= IRR” by selecting the spaces where the investment’s cash inflows and outflows are found.

Example of IRR in Excel

In the example below, we put all the cash flow in a spreadsheet and at the end, in the last cell, type “= IRR (B2: B6)”, select Enter and get the respective rate of 5.192%.

With this value for the IRR, we can compare it with the investment attractiveness rate, which if it is some value like 4%, we know that the investment is worth it.

How to Calculate IRR on an HP 12c Financial Calculator

The IRR becomes simpler to solve on a financial calculator, such as the HP 12c, one of the most used.

For the calculation we use the blue color functions of the calculator when we press the “g” key and the orange color functions by pressing the “f” button to calculate the IRR where we see “IRR” written.

In addition to these, we should leave the initial investment value at a negative value, since it represents an outflow of money. To do this, we select this value and then the “CHS” key.

The steps for the calculation are:

- Enter the initial investment → CHS → g → CFo;

- Enter each cash flow amount → g → CFj;

- If any cash flow is repeated, just select the amount of that repetition → g → Nj;

- At the end we find out the IRR value by pressing f →

HP 12c example

As an example for calculating the IRR in an investment of R $ 70,000.00 and cash flows, one of R $ 12,000.00 and another 5 of R $ 10,000.00, we typed in the calculator:

- 70,000 → CHS → g → CFo;

- 12,000 → g → CFj;

- 10,000 → g → CFj, and as this cash flow is repeated 10 more times, we still do: 10 → g → Nj;

- We discover the IRR by doing: f →

We then obtain an IRR of 8.97%.

With this value, we know that, with the investment rate being 10%, the investment is not worth it, since we suffer a loss.